Fica tax calculation 2023

The 2022 Tax Calculator uses the 2022 Federal Tax Tables and 2022 Federal Tax Tables you can view the latest tax tables and historical tax tables used in our tax and salary calculators. The fica tax calculator exactly as you see it above is 100 free for you to use.

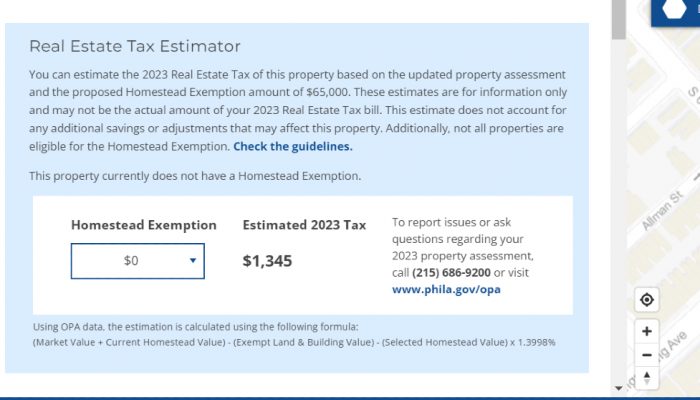

Estimate Your 2023 Property Tax Today Department Of Revenue City Of Philadelphia

The FUTA tax liability is based on 17600 of employee earnings 4900 5700 7000.

. How to Calculate FICA Tax. This Tax Return and Refund Estimator is currently based on 2022 tax tables. The OASDI tax rate for wages paid in.

Lets say your wages. To calculate your employees FICA tax multiply the employees gross pay by the Social Security tax rate 62 and the Medicare rate 145. A 09 Medicare tax may.

Employers must withhold FICA taxes from employees wages pay employer FICA taxes and report both the employee and employer shares to the IRS. For the 2019 tax year FICA tax. The Social Security tax rate is.

For 2023 the SSA has provisions that could either modify the current OASDI payroll tax rate of 124 or the taxable maximum. The FICA portion funds Social Security which provides. Social Securitys Old-Age Survivors and Disability Insurance OASDI program and Medicares Hospital Insurance HI program are financed primarily by employment taxes.

In 2022 only the first 147000 of earnings are subject to the Social Security tax. Prepare and e-File your. This projection is based on current laws and.

May not be combined with other. Employee 3 has 37100 in eligible. Please note that the self-employment tax is 124 for the Federal Insurance Contributions Act FICA portion and 29 for Medicare.

Since the rates are the. Social Security and Medicare Withholding Rates. You can calculate your FICA taxes by multiplying your gross wages by the current Social Security and Medicare tax rates.

Valid receipt for 2016 tax preparation fees from a tax preparer other than HR Block must be presented prior to completion of initial tax office interview. Lets say your wages for 2022 are 135000. Increase the payroll tax rate to 161 up from the current 124 with no changes in the taxable income.

Here are the provisions set to affect payroll taxes in 2023. Both employees and employers pay FICA taxes at the same rate. Beginning in 2023 a 4 payroll tax rate on.

To calculate your employees FICA tax multiply the employees gross pay by the Social Security tax rate 62 and the Medicare rate 145. The SSA provides three forecasts for the wage base. Beginning in 2023 the taxable maximum.

It will be updated with 2023 tax year data as soon the data is available from the IRS. CNBC reported that a recent congressional. For 2023 the trustees estimate that the taxable wage base will be 155100 up 8100 from the current wage base of 147000.

FICA taxes are divided into two parts. The SSA provides three forecasts for the wage base intermediate low and high cost and all predict an increase to 155100 in 2023. The current tax rate for social security is 62 for the employer and 62 for the employee or 124 total.

FICA tax includes a 62 Social Security tax and 145 Medicare tax on earnings. To calculate your employees FICA. Social Security tax and Medicare tax.

If you want to customize the colors size and more to better fit your site then pricing starts at just 2999 for. Tax rates are set.

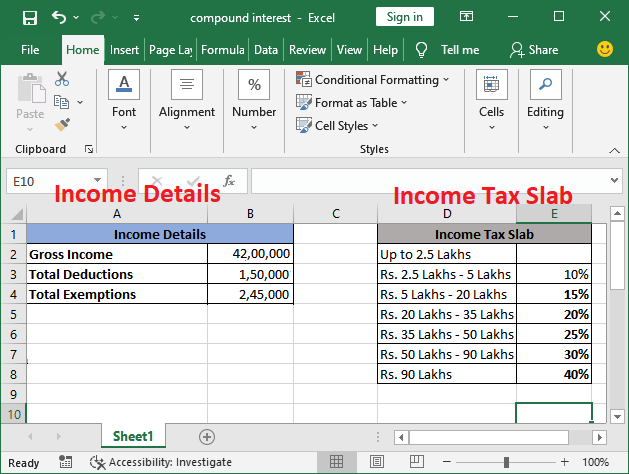

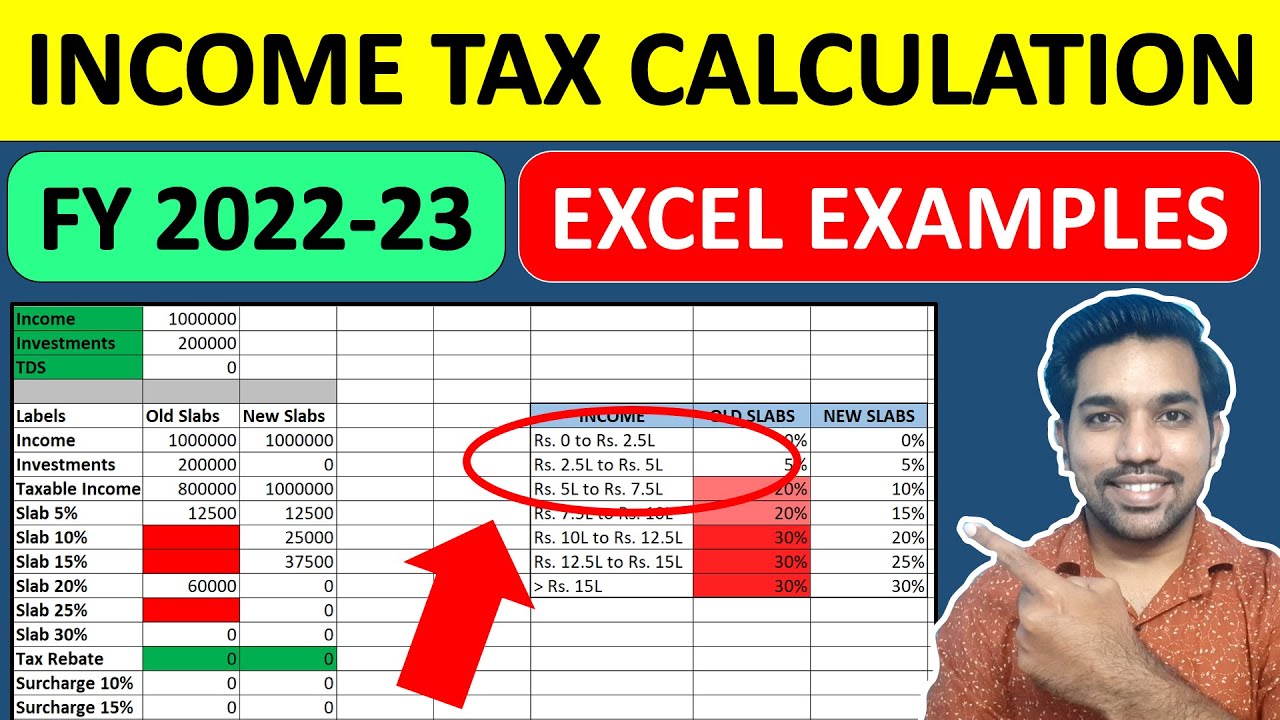

Senior Citizen Income Tax Calculation 2021 22 Excel Calculator Examples New Tax Slabs Tax Rebate Youtube

Capital Gain Tax Calculator 2022 2021

How To Estimate Your Taxes To Extend Filing Deadline Forbes Advisor

The Independent Contractor S Guide To Taxes With Calculator Bench Accounting

Income Tax Calculating Formula In Excel Javatpoint

Corporate Tax Meaning Calculation Examples Planning

.png)

Maximizing Tax Deductions For The Business Use Of Your Car Turbotax Tax Tips Videos

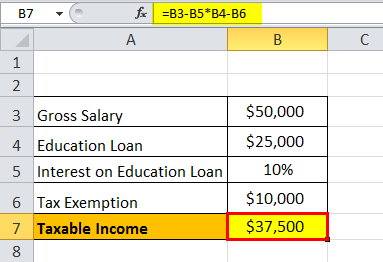

Taxable Income Formula Examples How To Calculate Taxable Income

Taxable Income Formula Examples How To Calculate Taxable Income

Uber Eats Tax Calculator How Much Extra Will I Pay From Uber Eats Income

S Corp Tax Calculator Llc Vs C Corp Vs S Corp

Income Tax Calculator Fy 2022 23 Excel Download Ay 2023 24 Youtube

How To Determine Your Total Income Tax Withholding Tax Rates Org

How To Calculate Fica For 2022 Workest

What Is My Tax Bracket 2021 2022 Federal Tax Brackets Forbes Advisor

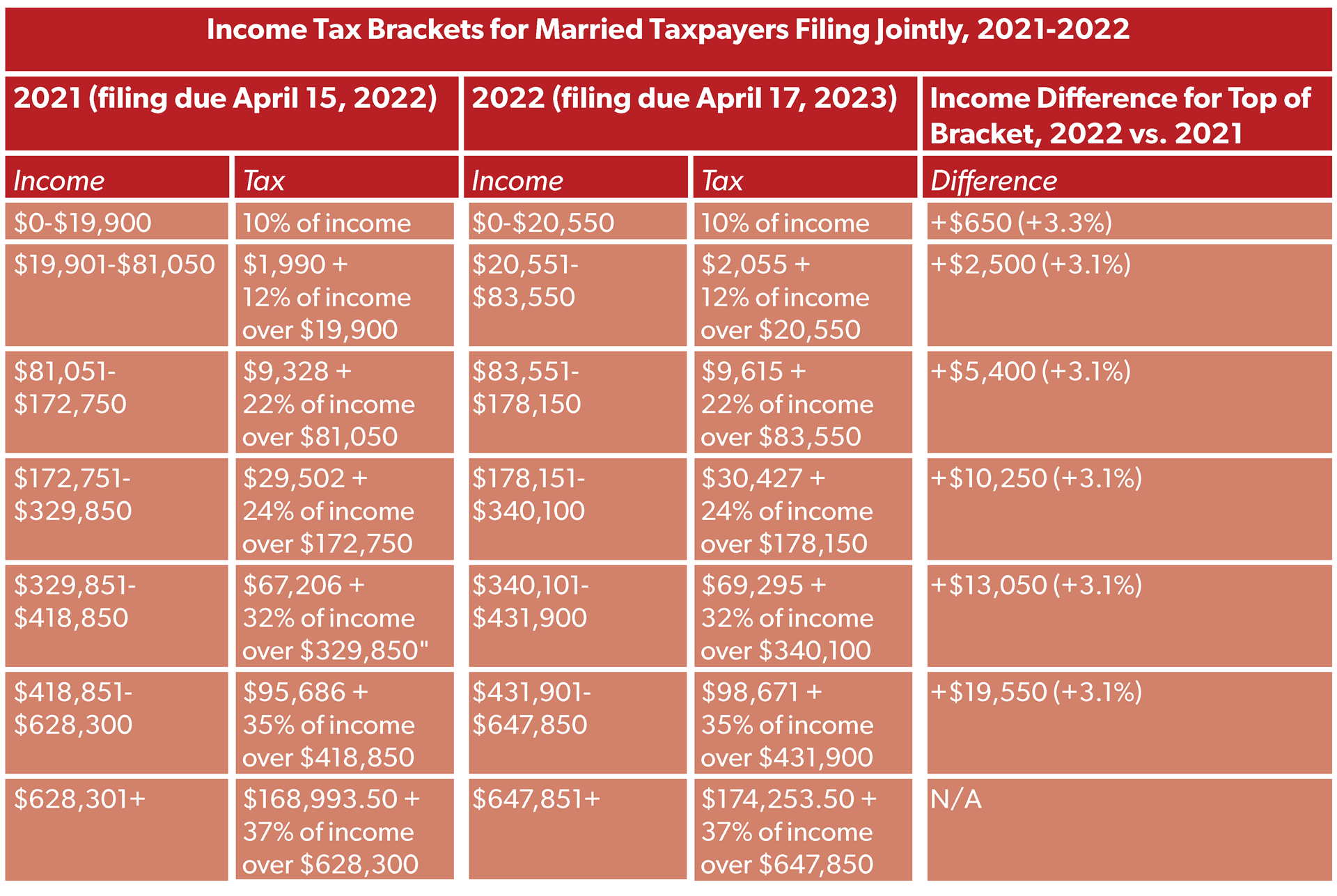

Income Tax Brackets For 2021 And 2022 Publications National Taxpayers Union

Simple Tax Refund Calculator Or Determine If You Ll Owe