Federal payroll calculator 2023

Type of federal return filed is based on taxpayers personal situation and IRS rulesregulations. Enter your filing status income deductions and credits and we will estimate your total taxes.

What Is My Tax Bracket 2021 2022 Federal Tax Brackets Forbes Advisor

States and cities that impose income taxes typically have their own brackets with rates that tend to be lower than the federal governments.

. If you compute payroll manually your employee has submitted a Form W-4 for 2020 or later and you prefer to use the Wage Bracket method use the worksheet below and the Wage Bracket Method tables that follow to figure federal income tax withholding. I did create a Paycheck Calculator to estimate tax withholdings and calculate net take home pay. Gift taxes and estate taxes are connected.

The federal solar tax credit for solar energy upgrades to your home may not be around for much longer. Withholding schedules rules and rates are from IRS Publication 15 and IRS Publication 15T. This calculator uses the redesigned W-4 created to comply with the elimination of exemptions in the Tax Cuts and Jobs Act TCJA.

You can leave up to that amount to relatives or friends free of any federal estate taxIf youre married your spouse is entitled to a separate 117 million exemption. Florida Hourly Paycheck and Payroll Calculator. Form 1040EZ is generally used by singlemarried taxpayers with taxable income under 100000 no dependents no itemized deductions and certain types of.

Federal tax law allows you to claim a deduction for the business mileage if youre not reimbursed for the expense. Last day you can work if you. News for 2023 GS Pay Scale.

Estimate your tax refund and. First day you can file your 2023-2024 FAFSA use your 2021 tax information. Please note this calculator is for the 2022 tax year which is due in April 17 2023.

Self-Employed TurboTax Live TurboTax Live Full Service or with PLUS benefits and is available through 12312023. Payroll Payroll services and support to keep you compliant. Based on your projected tax withholding for the year we can also estimate your tax refund or amount you may owe the IRS.

Easily calculate your tax rate to make smart. In Fiscal Year 2023 in keeping with the usual practice contractual employees may receive an increment at the employing agencys discretion. Before sharing sensitive information make sure youre on a federal government site.

1040 Tax Estimation Calculator for 2022 Taxes. If your EOD falls between July 1 and December 31 you will receive your increment in July 2022. Online Registration Application For assistance with elementary school registration please call 404 361-3428 to speak with an elementary school registrar or email email protected.

Heres how to claim this credit. Treasury Securities Direct Deposit. IT is Income Taxes.

Type of federal return filed is based on your personal tax situation and IRS rules. More about Federal Holidays. 2 2022 The presidents alternative pay plan is an across-the-board base pay increase of 41 and a locality pay increase of an average of 05 Locality Pay Increases Could Affect 30000 Federal Employees.

2022 Income Tax Brackets Taxes Due April 2023 Or October 2023 With An Extension For the 2022 tax year there are also seven federal tax brackets. This Tax Return and Refund Estimator is currently based on 2022 tax tables. Be sure the software can remind you when payments are due.

Terms and conditions may vary and are subject to. After viewing the video tutorial click on each image below to register your student for the 2022-2023 school year. For both federal and state payroll taxes.

FY 2023 Per Diem Rates Now Available Please note. Payroll software can help you with all the details and can make the deposits for you by connecting with your payroll account. Injury and Illness Calculator.

1300 per hour. As a credit you take the amount directly off your tax payment rather than as a deduction of your taxable income. Use this simplified payroll deductions calculator to help you determine your net paycheck.

It is only observed by government employees in Washington DC. The FY 2023 rates are NOT the default rates until October 1 2022. You have a 117 million federal estate tax exemption for 2021.

In addition to the eleven annual federal holidays Inauguration Day is a twelfth holiday designated by Congress for observance every four years on January 20 following a US. Federal government websites often end in gov or mil. It will be updated with 2023 tax year data as soon the data is available from the IRS.

Employment verifications may be sent to the Payroll Office 878-4124. But instead of integrating that into a general. This calculator is integrated with a W-4 Form Tax withholding feature.

Wage Bracket Method Tables for Manual Payroll Systems With Forms W-4 From 2020 or Later. Some taxes are paid by the employee some by you and some are shared between you and your employee. Afena Federal Credit Union located in Marion Indiana is open to membership in Grant and Wabash County and is committed to help its members reach their financial goals.

22 for equipment placed in service in 2023. And the border counties of Maryland and Virginia. Florida employers are responsible for withholding and paying the same federal payroll taxes as employers in the 49 other states.

White House Formalizes Average 46 Pay Raise for Federal Employees in 2023 Sept. We also offer a 2020 version. 10 12 22 24 32 35 and 37.

There have been several major tax law changes as of tax year 2013 including several that are the result of new Obamacare-related taxes. Complete all personnel and payroll related paperwork. As a new employer I set out to create a Payroll Calculator but in the process learned that there were too many laws and regulations associated with payroll to risk using a spreadsheet for calculating payroll.

State Employees Federal Credit Union US. If your EOD falls between January 1 and June 30 you will receive your increment in January 2023. Open enrollment for 2023 health coverage begins nationwide on November 1 2022 note that New York generally delays the start of open enrollment until mid-November but then has an extended deadline for the end of the enrollment period.

In the majority of the states open enrollment for 2023 coverage will run through January 15 2023. You must follow these instructions to view the FY 2023 rates. Form 1040EZ is generally used by singlemarried taxpayers with taxable income under 100000 no dependents no itemized deductions and certain types of income including wages salaries tips some scholarshipsgrants and unemployment compensation.

Federal calculations will now use the official federal tax brackets and deductions and state calculations will use the most recent brackets available. CareerTechnical Education Teachers Middle School. Select FY 2023 from the drop-down box above the Search By City State or ZIP Code or Search by State map.

California has the highest state income tax at 133 with Hawaii 11 New Jersey 1075 Oregon 99 and Minnesota 985 rounding out the top five. The lookback period for 2023 would be the 12-month period ending June 30 2022. The Federal Work-Study FWS Program is a federally subsidized employment program which provides part-time work opportunities for undergraduate and graduate students.

2021 2022 Federal Income Tax Brackets Tax Rates Nerdwallet

Pin On Information

2022 Public Service Pay Calendar Canada Ca

When Are Federal Payroll Taxes Due Deadlines Form Types More

2022 Federal State Payroll Tax Rates For Employers

Page Not Found Isle Of Man Isle Quiet Beach

2022 Federal Payroll Tax Rates Abacus Payroll

Pin On Ttcu News

2022 Federal State Payroll Tax Rates For Employers

2021 2022 Federal Income Tax Brackets Tax Rates Nerdwallet

When Are Taxes Due In 2022 Forbes Advisor

When Are Federal Payroll Taxes Due Deadlines Form Types More

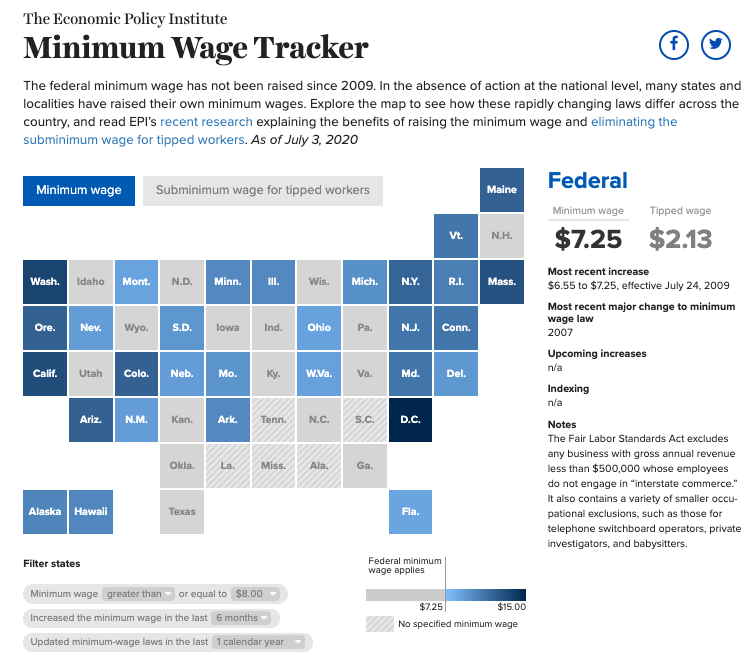

Minimum Wage Tracker Economic Policy Institute

2022 Public Service Pay Calendar Canada Ca

State Corporate Income Tax Rates And Brackets Tax Foundation

Pre Tax And Post Tax Deductions What S The Difference Aps Payroll

Pay Scale Revised In Budget 2022 23 Chart Grade 1 To 21 Bise World Pakistani Education Entertainment Salary Increase Salary Math Tutorials